Corporate tax timelines do not need to be confusing. In the UAE, the general rule is simple: your corporate tax return and payment are due within 9 months after the end of your financial year. The nuance comes from your first tax period, your entity type, and whether you operate in a Free Zone. Below is a practical, 2026-ready guide that answers When Are Corporate Taxes Due, with examples, comparisons, lessons learned, and actions your finance team can take now.

When Are Corporate Taxes Due in the UAE?

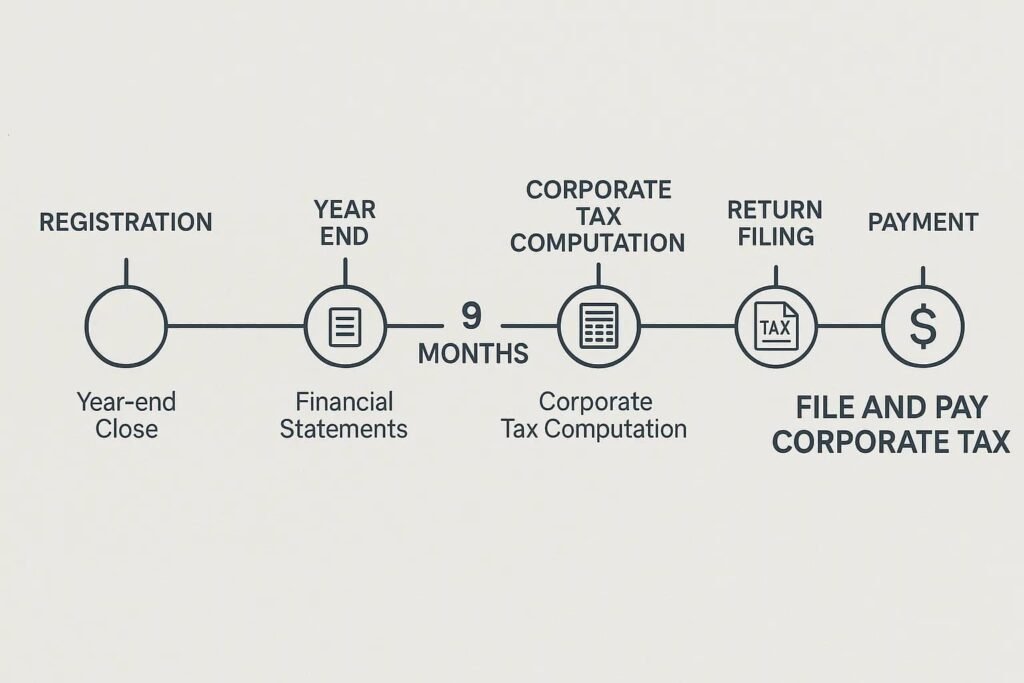

Under the UAE Corporate Tax Law, most companies file one return per year and pay any tax due by the same deadline, 9 months after the end of the tax period. The standard corporate tax rate is 9 percent on taxable income above AED 375,000, and 0 percent up to AED 375,000.

Key points to remember:

- First tax period starts on or after 1 June 2023, depending on your financial year.

- Return filing and payment are both due 9 months after your period end.

- Qualifying Free Zone Persons are still required to register and file.. Preferential rates can apply to qualifying income if conditions are met, and audited financial statements are generally required for QFZPs.

- Natural persons with business income above the relevant threshold must register. Their tax period is the calendar year, and returns are generally due by 30 September of the following year.

For primary guidance, see the UAE Ministry of Finance overview on corporate tax and FTA corporate tax guidance pages: UAE Ministry of Finance and Federal Tax Authority.

Quick due date examples

| Financial year end | First UAE CT period covered | Return due date | Payment deadline |

| 31 Dec 2024 | 1 Jan 2024 to 31 Dec 2024 | 30 Sep 2025 | 30 Sep 2025 |

| 31 Mar 2025 | 1 Apr 2024 to 31 Mar 2025 | 31 Dec 2025 | 31 Dec 2025 |

| 30 Jun 2024 | 1 Jul 2023 to 30 Jun 2024 | 31 Mar 2025 | 31 Mar 2025 |

| 31 May 2024 | 1 Jun 2023 to 31 May 2024 | 28 Feb 2025 | 28 Feb 2025 |

| 30 Sep 2024 | 1 Oct 2023 to 30 Sep 2024 | 30 Jun 2025 | 30 Jun 2025 |

Tip, if you run a calendar year, your 2024 return and payment were due 30 September 2025. Your 2025 return and payment will be due 30 September 2026.

Registration matters, especially for 2025 onward

The FTA rolled out staggered registration deadlines in 2024 based on license issuance month and legal form. If you incorporated earlier and missed those windows, register immediately to avoid administrative penalties. New entities must register within the FTA timeframes communicated at incorporation. If you are unsure, engage Corporate Tax Registration Services to review your status and complete your profile.

- If you trade through a Free Zone entity, confirm whether you seek Qualifying Free Zone Person status. Registration and annual filing still apply.

- Natural persons with business or professional income above the threshold must register and file for corporate tax on a calendar year basis.

ADS Auditors supports Corporate Tax Registration Services in Dubai and across the UAE, guiding you through FTA onboarding and avoiding late-registration penalties.

Global comparisons to put UAE deadlines in context

Understanding other jurisdictions helps multinationals plan cash and close cycles.

- In The United States, C corporations generally file 4 months and 15 days after year end, for calendar-year companies this is mid-April. Extensions do not extend payment.

- In The United Kingdom, corporation tax is usually paid 9 months and 1 day after the period ends for small and non-large companies, the CT600 return is due 12 months after the period ends.

- United Arab Emirates, return filing and payment are both due 9 months after the period ends, a single annual cycle that aligns well with statutory close and audit.

The UAE’s single 9-month filing and payment rule is convenient for cash flow planning, but it concentrates work into a single deadline. Many finance leaders in Dubai mitigate this by locking their accounting close earlier and running a pre-audit corporate tax computation by month 6.

Strategic playbook for never missing a deadline

- Lock your tax calendar early

- Map your financial year end and add the 9-month date for filing and payment.

- Add internal checkpoints, month 1 close complete, month 3 draft tax computation, month 5 audit ready, month 7 final sign offs.

- Align VAT and corporate tax data

- Reconcile VAT returns to revenue and expense ledgers each quarter. Data mismatches are a top trigger for corporate tax questions.

- If you use multiple ERPs or banks, centralised ledgers to reduce manual reconciliations.

- Document related-party pricing

- UAE transfer pricing rules require arm’s length pricing. Prepare intercompany agreements and keep contemporaneous support. Many groups target a master file and a local file ready by the filing deadline even when thresholds are not met, to speed responses.

- Consider Small Business Relief if eligible

- If your revenue does not exceed AED 3 million in the relevant periods, Small Business Relief may apply, which can reduce the payable tax to zero while maintaining filing and record-keeping obligations. Review interactions with Free Zone elections and group structures before relying on relief.

- Use a rolling provision

- Book a monthly tax provision. This avoids cash surprises at month 9 and helps investors understand after-tax profitability.

Lessons learned from recent UAE filings

- Case 1, calendar-year tech startup, The company assumed Small Business Relief meant no return. They missed the 30 September deadline. Outcome, they still had to file, and penalties applied for late filing. Lesson, relief affects tax payable, not the filing duty.

- Case 2, Free Zone logistics firm, The team planned for 0 percent on all income. A portion of revenue did not qualify under the rules, and intercompany service charges lacked documentation. Lesson, map income streams to qualifying criteria early, and prepare transfer pricing support before audit finalization.

- Case 3, regional group with multiple UAE entities, The group adopted a tax group in 2024 but kept legacy eliminations in the consolidation workbook. Lesson, once a tax group election is in place, adjust processes for a single return and ensure eliminations match the tax group perimeter.

Data snapshot you can use now

- Corporate tax rate, 0 percent up to AED 375,000, 9 percent above that.

- Filing and payment timing, 9 months after the end of the tax period.

- Small Business Relief, generally available where revenue does not exceed AED 3 million during the specified window through the year ends up to 31 December 2026, subject to conditions.

- Qualifying Free Zone Persons, preferential rate on qualifying income if conditions are met, annual filing and audited financial statements typically required.

A simple table to guide your internal calendar planning:

| Step | Target timing after year end | Owner |

| Management accounts closed | Month 1 | Finance |

| Tax data pack and VAT tie-outs | Month 2 | Finance |

| Draft CT computation | Month 3 to 4 | Finance and tax advisor |

| Audit finalization | Month 5 to 6 | Finance and auditor |

| Return approval and payment setup | Month 7 to 8 | CFO and treasury |

| File and pay | Month 9 | Authorized signatory |

Frequently Asked Questions

When are corporate taxes due for a calendar-year UAE company?

30 September of the following year, both the return and payment are due together.

Do Free Zone companies need to file if they expect 0 percent?

Yes. Free Zone entities must register and file. Preferential treatment depends on meeting Qualifying Free Zone Person conditions, and audited financial statements are generally required for QFZPs.

Do I need to make advance or quarterly corporate tax payments in the UAE?

No routine advance payments are required. Payment is due with the annual return, 9 months after the period ends.

What if my company incorporated in 2025?

You still follow the 9-month rule based on your chosen financial year. For example, a company with a 31 December 2025 year end will generally file and pay by 30 September 2026. Register with the FTA as soon as you are required to do so.

What happens if I miss the filing or payment deadline?

Administrative penalties and late payment interest can apply under FTA rules. These are assessed per the FTA’s published schedules, so act quickly to file and pay to minimize exposure.

Can I align my VAT and corporate tax processes?

Yes, and you should. Reconcile VAT figures back to your trial balance quarterly. Consistency reduces review queries at corporate tax filing time.

How ADS Auditors can help

ADS Auditors provides Corporate Tax Registration Services in Dubai, annual compliance, VAT and accounting support, and a practical compliance calendar tool to keep your team on track. Whether you are a Free Zone company seeking clarity on qualifying income, a startup evaluating Small Business Relief, or a multinational aligning transfer pricing, our team helps you file accurately and on time.

- Book a consultation with ADS Auditors to map your filing and payment dates, and to set up a month-by-month close plan.

- Get hands-on support to register with the FTA, prepare computations, and file your corporation tax return without last-minute pressure.

Visit ADS Auditors to get started.

Disclaimer, This article provides general information as of December 2025 and does not constitute tax advice. Always consult the relevant UAE legislation and the Federal Tax Authority’s guidance or seek professional advice for your specific facts.