Cash flow is the number one reason businesses ask, “Can Corporation Tax Be Paid in Installments?” In the UAE, corporate tax is still relatively new for many founders and investors and a single payment date can feel like a shock if you are not building reserves during the year.

The good news is that there are practical ways to smooth the cash impact. The key is to separate two different ideas:

- Paying your corporate tax liability through multiple payments before the deadline (cash planning).

- Requesting an official installment plan or payment arrangement (a formal process, not guaranteed).

Below is a clear, UAE focused guide to the rules, your real options and strategies we see working in practice.

what the UAE corporate tax rules say about paying tax?

In the UAE, corporate tax is administered by the Federal Tax Authority (FTA). Corporate tax returns and the related payment are generally due within 9 months from the end of the relevant tax period (for most businesses, that means 9 months after your financial year end). You can confirm the high level framework on the UAE Ministry of Finance corporate tax page.

A few points that matter for payment planning:

- Corporate tax is a self assessed regime. Your accounting records, adjustments and calculations drive the payable amount.

- The standard headline rate for many businesses is 0 percent on taxable income up to AED 375,000 and 9 percent above that threshold (subject to the law and your specific status).

- Payment timing is strict. If you miss the deadline, penalties and possible interest outcomes can apply under the tax procedures and penalties framework. For details, always check official FTA guidance.

This is why installment thinking is mainly a cash management topic first and a legal relief option second.

Can Corporation Tax Be Paid in Installments in the UAE?

Option 1: “Installments” as a cash planning strategy (before the due date)

Many companies treat corporate tax like a monthly accrual, even if the legal payment is due later.

In simple terms, you estimate your likely corporate tax for the year and set aside money every month (or quarter). When the due date arrives, you already have the cash.

This approach is especially important because small businesses often do not keep large cash buffers. The JPMorgan Chase Institute has reported that many small businesses keep less than a month of cash buffer on average (often cited around 27 cash buffer days in their small business cash flow research). See the JPMorgan Chase Institute insights for background.

Even if you ultimately pay in one transfer, the business experience feels like installments because you funded it in parts.

Option 2: An official installment arrangement (if you cannot pay on time)

A formal “pay in installments” arrangement is different. It usually requires an application and approval and it is not something you should assume will be granted.

In many tax systems, payment plan approvals depend on factors such as:

- Your compliance history (timely registration and filing)

- Financial hardship evidence (cash flow, bank statements)

- A realistic repayment schedule

- Sometimes guarantees or additional conditions

Because FTA processes and available options can evolve, the safest approach is to check the current FTA guidance and your EmaraTax portal options, then decide whether a request is appropriate.

If your business is in this situation, it is worth speaking with tax consultants in Dubai who handle FTA communications frequently, so you avoid making the problem worse with late filings or incomplete submissions.

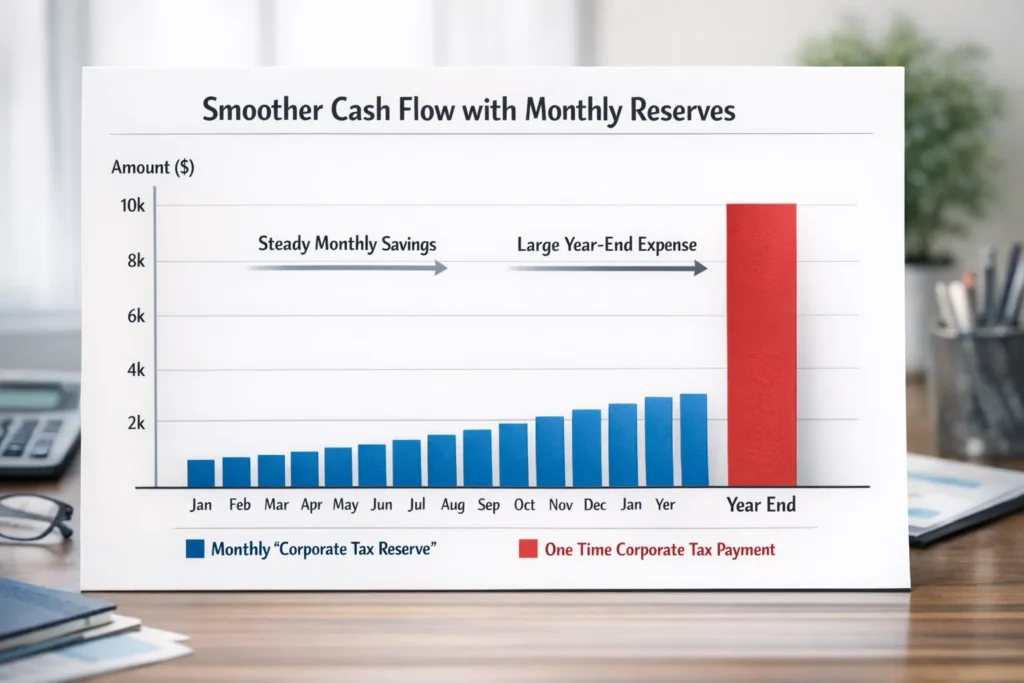

A simple chart example: lump sum payment vs “true installments” planning

Here is a practical example using easy numbers.

Assume:

- Financial year: Jan to Dec

- Taxable income: AED 2,000,000

- Corporate tax: 0 percent on first AED 375,000, then 9 percent on AED 1,625,000

- Estimated corporate tax payable: AED 146,250

If you build the reserve monthly, you would set aside about AED 12,187.50 per month.

| Approach | What you do during the year | Cash impact when tax is due | Risk level |

| Lump sum only | No set aside, pay at deadline | Large one time outflow | Higher |

| “Installments” via monthly reserve | Set aside AED 12,187.50 per month | Minimal shock at deadline | Lower |

| Formal payment plan request | Pay late, then request a schedule | Staged payments but may include penalties | Highest |

What businesses can realistically do if cash is tight?

The best option depends on whether you are still before the due date or already close to missing it.

If you are still months away from the deadline

Focus on reducing uncertainty and building reserves.

- Improve forecasting with a quarterly close (even if you are a small business). If you do not know your profit until year end, your corporate tax reserve will be guesswork.

- Separate VAT cash from operating cash. VAT is not revenue and mixing it with working capital is a common reason businesses struggle at payment time. If you need support, VAT Filing Services in Dubai can help you set a clean process.

- Use a “tax reserve” bank sub account and automate transfers.

If you are near the deadline and cannot pay the full amount

You need a fast, decision driven approach.

Compare these paths:

| Path | When it makes sense | What to watch |

| Short term financing | You have predictable collections coming | Financing costs, covenants |

| Negotiate faster collections | You have large receivables | Customer relationship impact |

| Asset sale or owner funding | One time gap that will not repeat | Do not create chronic dependency |

| Request an FTA arrangement | Genuine hardship and you can document it | Approval is not automatic, compliance still required |

Investor style examples: what works in real life (and what fails)

To make this practical, here are scenarios that commonly appear for investors and founders in the UAE. These are illustrative examples, not client claims.

Example 1: E-commerce importer with seasonal sales spikes

- What went wrong: strong sales in Q4, but cash tied in inventory and shipping costs.

- What worked: a monthly corporate tax reserve plus a “VAT lockbox” approach, where VAT collected is separated weekly.

- Lesson learned: treat tax like cost of goods sold timing. If inventory is seasonal, tax planning must be seasonal too.

Example 2: Real estate holding SPV with irregular rental cycles

- What went wrong: the entity relied on a single rent payment cycle and delayed maintenance invoices hit at the same time.

- What worked: quarterly management accounts and a conservative reserve based on worst case occupancy.

- Lesson learned: corporate tax is profit based, but cash is cycle based. Model both.

Example 3: Consultancy firm with milestone billing

- What went wrong: profits looked high on paper, but invoices were paid late.

- What worked: contract changes to add partial upfront payments and faster invoicing right after milestone sign-off.

- Lesson learned: reducing days sales outstanding can be more effective than searching for “installments.”

Where corporate tax registration and audits connect to installment decisions?

Many payment problems start earlier, during setup.

- If your corporate tax registration UAE steps are delayed or inaccurate, you risk deadline stress and rushed filings.

- If your books are weak, your tax estimate will be unreliable, so your reserve will be wrong.

- If you are in a free zone or have cross-border activity, you may need a deeper review to confirm the correct treatment.

This is where working with experienced corporate tax consultants in Dubai and reputable audit firms in Dubai becomes a strategic move, not an admin cost.

If you want a clear starting point, ADS Auditors can support Corporate Tax Registration Services in Dubai and ongoing advisory so your payment planning is based on real numbers, not assumptions.

You can also review ADS Auditors resources on deadlines and planning, such as the guide to knowing your corporate tax deadline and corporate tax registration in Dubai.

Practical tips to avoid needing an installment plan later

Most businesses do not get into trouble because the rate is high. They get into trouble because they were surprised.

- Build a monthly “corporate tax reserve” transfer from day one.

- Do a quarterly profit checkpoint so you update your estimate.

- Keep VAT filing clean and on time, because VAT errors often reveal bookkeeping gaps that later affect corporate tax.

- Use a compliance calendar and assign an internal owner, even if you outsource execution.

Need a clear corporate tax payment plan for your business?

If you are trying to plan ahead, or you are worried you may not be able to pay your corporate tax in one lump sum, ADS Auditors can help you map your corporate tax timeline, estimate liability using accurate records and build a practical strategy that protects compliance and cash flow.

Explore ADS Auditors or contact the team to discuss corporate tax advisory, registration and VAT coordination with your accounting process.

FAQS

Can Corporation Tax Be Paid in Installments in the UAE?

In practice, many businesses handle this by setting aside money monthly and paying the full amount by the due date. A formal installment arrangement, if available, is typically a request based process and not automatic, so you should confirm current FTA options and get professional advice.

Will the FTA allow a payment plan if my company cannot pay on time?

depends on your case, your compliance history and the supporting documents you can provide. The FTA may accept or reject requests based on its rules and review.

Is it better to borrow money or request installments for corporate tax?

If you can borrow at a reasonable cost and stay fully compliant, financing can be cleaner than late payment risk. An installment request may be appropriate in genuine hardship situations, but you should evaluate penalties, conditions and approval uncertainty.

Does VAT affect corporate tax payment planning?

Yes. VAT is usually a major cash flow pressure point because it is collected and paid on a schedule. Clean VAT processes often prevent corporate tax cash shortfalls. Businesses that need help often use VAT Filing Services in Dubai to stabilize the cycle.

When should I speak with corporate tax consultants in Dubai about payments?

Ideally early in the tax period, not at the deadline. Advisors can help you estimate taxable income, build reserves and avoid late filing or payment problems.