SME founders in the UAE often hear the terms audit and assurance used as if they mean the same thing. They do not. Understanding the difference, and knowing what your company actually needs, can help you comply with UAE regulations, build lender and investor confidence, and make better decisions especially in a year when corporate tax, Tax Accounting Services in Abu Dhabi, and tightening compliance expectations are top of mind.

Audit vs. assurance in simple terms

- An audit is an independent examination of your financial statements that provides reasonable assurance that they are free from material misstatement. Audits in the UAE are performed under International Standards on Auditing and result in an auditor’s opinion, often supporting compliance needs such as VAT Registration in Ras Al Khaimah.

- Assurance is the broader category. It includes audits, but also reviews, agreed upon procedures, and other engagements that enhance the credibility of information. The level of comfort varies by engagement type and by the underlying standards used.

For authoritative definitions, see the International Auditing and Assurance Standards Board and its standards for audits, reviews, and other assurance engagements. You can explore their resources at the IAASB website

Common assurance options for UAE SMEs

| Engagement | Level of comfort | Core standard | Output | When UAE SMEs use it |

| Statutory audit of financial statements | High, reasonable assurance | International Standards on Auditing (ISA) | Audit report with opinion | Required by most free zone authorities, often expected under the Commercial Companies Law, demanded by banks and investors |

| Review engagement | Moderate, limited assurance | ISRE 2400 | Review conclusion | When a lender or investor needs comfort but a full audit is not required |

| Agreed upon procedures (AUP) | No assurance, factual findings | ISRS 4400 | Report of findings on specified procedures | To test specific areas, for example inventory counts, revenue cut off, or VAT reconciliations |

| Compilation | No assurance | Applicable compilation framework | Assembled financial statements | For internal use or early stage discussion, not sufficient for regulators or lenders |

What UAE rules and market practice mean for SMEs

The UAE has strengthened expectations around financial reporting and tax readiness. Key points to know in 2025:

- Most UAE companies must maintain proper books of account and are generally expected to appoint a licensed auditor. Requirements stem from the UAE Commercial Companies Law and from free zone regulations, which can mandate annual audited financial statements. Always verify the specific rules of your licensing authority.

- Free zones often require you to file audited financial statements each year. Many also require you to use an auditor from an approved list. For example, DMCC maintains an approved auditors register. See your free zone’s official site for rules and approved lists, for instance

- Under corporate tax, returns are generally due within 9 months of the end of the tax period. The Federal Tax Authority’s corporate tax hub provides current deadlines and guidance

- To qualify for the 0 percent regime as a Qualifying Free Zone Person, audited financial statements are among the conditions set by the UAE authorities. If this applies to you, speak to your advisor about ensuring your audit meets the required criteria.

- IFRS is widely adopted in the UAE. Many SMEs can apply IFRS for SMEs if permitted by their regulator and stakeholders. See the IFRS Foundation for frameworks and updates:

Because rules vary by free zone and legal form, confirm your specific filing and audit obligations with your licensing authority and tax adviser. The government portal is a useful starting point for business compliance information

Picking the right level of assurance

Not every situation calls for a full audit, but many do. Use these decision cues:

- Your license or regulator requires an audit, choose a statutory audit and a firm approved by your free zone if applicable.

- You plan to apply for bank financing or renew facilities, most banks in the UAE expect audited financial statements, especially for multi-year facilities or higher limits.

- You are seeking investors or participating in tenders, an audit increases credibility and reduces due diligence friction.

- You need comfort on a specific area, for example opening inventory or a revenue stream, consider agreed upon procedures targeted to that area.

- You want periodic comfort without the cost of a full audit, a review engagement may suit internal governance and selected stakeholder requests.

How audit and assurance create real value for SMEs

- Better access to finance, lenders in the UAE rely on audited numbers to assess risk and set limits.

- Stronger tax readiness, reconciled financials that align to VAT and corporate tax records reduce compliance risk and speed filings.

- Governance and fraud deterrence, independent testing of controls and transactions increases accountability.

- Operational insights, management letters highlight control gaps and process improvements that save time and cost.

- Stakeholder confidence, timely, clean opinions build trust with partners, customers, and regulators.

What auditors focus on for UAE SMEs

Auditors use a risk based approach. Expect attention on these areas common in local SME environments:

- Revenue recognition and cut off under IFRS 15, particularly where contracts include milestones, variable consideration, or bundled goods and services.

- Leases under IFRS 16, tenancy and equipment contracts often require right of use assets and lease liabilities on the balance sheet.

- Inventory existence and valuation, procedures may include attendance at counts and testing of write downs for slow moving stock.

- Related party transactions, clear documentation of terms and approvals is expected.

- VAT reconciliation, auditors often test the bridge from general ledger to VAT returns to identify misclassifications and unreported adjustments.

- Payroll and end of service benefits, obligations must be measured and recognized under applicable standards.

- Cash and bank balances, third party confirmations are standard.

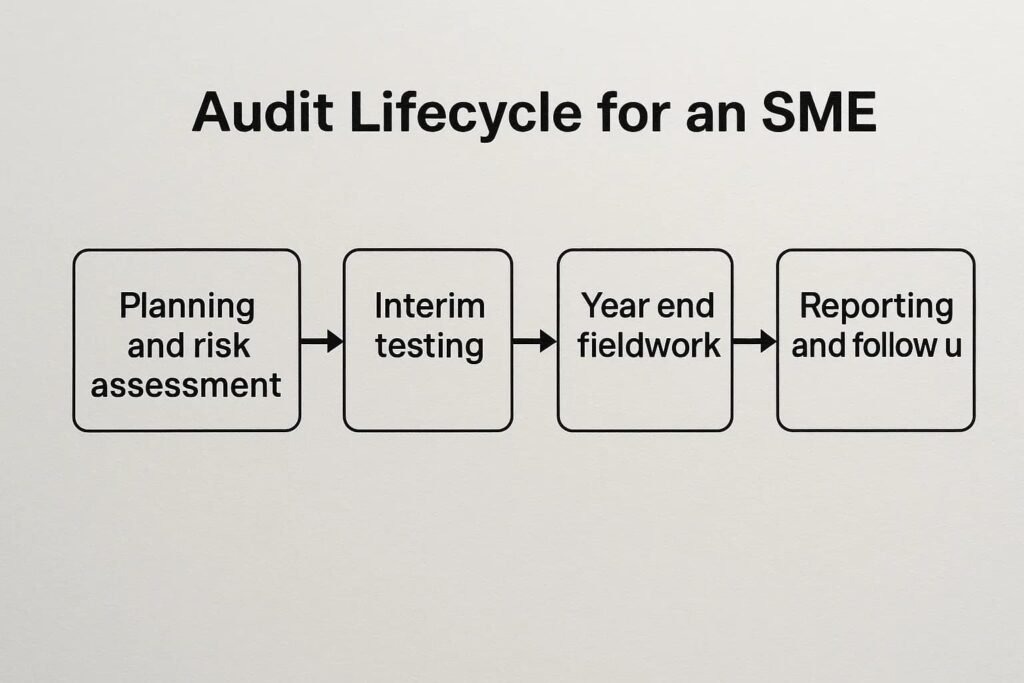

A practical audit timeline for SMEs

Each engagement is different, but this cadence helps most UAE SMEs finish on time and avoid rush fees:

- Weeks 1 to 2, planning and PBC list. Agree scope, materiality, and deadlines. Share a prepared by client list covering trial balance, lead schedules, and key contracts.

- Weeks 3 to 4, interim testing. Auditors perform walkthroughs, control testing, and sample substantive tests on revenue, purchases, payroll, and VAT reconciliations.

- Weeks 5 to 7, year end fieldwork. Focus on closing adjustments, estimates, inventory, bank confirmations, and subsequent events.

- Weeks 8 to 9, reporting and sign off. Clear review notes, finalize the financial statements, and issue the audit opinion. If your regulator requires filing, submit within its deadline.

Tip, plan your physical inventory counts in advance and invite your auditor. Missing a year end count can delay or complicate your audit.

Cost drivers, and how to keep your audit efficient

Audit fees reflect effort and risk. You can influence both by being ready and predictable.

| Cost driver | Why it matters | How SMEs can reduce effort |

| Ledger quality and reconciliations | Clean, reconciled balances reduce testing and rework | Reconcile banks, VAT, receivables, payables, and intercompany before fieldwork |

| Documentation and contracts | Missing documents slow testing and increase sampling | Centralize trade licenses, leases, major contracts, board resolutions, and loan agreements |

| Inventory counts and controls | Physical verification often required | Schedule supervised counts, maintain count sheets, and align to the ledger quantities |

| Number of locations or entities | More branches and consolidations increase complexity | Standardize close checklists and cut off procedures across locations |

| IFRS complexity, for example leases or revenue | Complex estimates and models need more audit evidence | Prepare accounting memos, assumptions, and calculations with supporting evidence |

| Frequent post close changes | Late adjustments trigger re testing | Freeze the trial balance by a set date and track proposed adjustments separately |

Getting audit ready, a concise checklist

- Choose your financial reporting framework and accounting policies early, IFRS or IFRS for SMEs as accepted by your regulator and stakeholders.

- Confirm whether your free zone requires an auditor from its approved list, and appoint a licensed firm early to lock timelines.

- Close your books with a month by month close checklist, including bank, VAT, and key sub ledger reconciliations.

- Document significant judgments, for example revenue recognition models, impairment assessments, and lease calculations.

- Prepare for third party confirmations, banks, lawyers, and major customers or suppliers.

- Align corporate tax data with your financials, for example fixed asset schedules, carry forward losses, and related party disclosures. The FTA corporate tax page provides current filing information

Assurance beyond the financial statements

Many UAE SMEs now face broader compliance expectations. Assurance services can help you demonstrate control and readiness in these areas too:

- VAT process reviews and agreed upon procedures on VAT returns, to validate filings before an FTA review.

- Corporate tax readiness assessments, to test data quality and disclosure completeness ahead of filing.

- Economic Substance Regulation and Anti Money Laundering control reviews, to identify gaps and prepare for regulator inspections.

- Non financial assurance under ISAE 3000, for example on ESG data that large customers request from suppliers.

How ADS Auditors supports UAE SMEs

ADS Auditors is an award-winning consultancy based in Dubai that serves SMEs across the UAE and internationally. The team delivers audit and assurance engagements tailored to your license requirements and stakeholder expectations, and integrates these with Corporate Tax Consultants Services in Dubai and other related services that matter to growing businesses in 2025.

- External audit and assurance aligned to ISA and IFRS, right sized to your risk and timeline.

- Corporate tax and VAT advisory integrated with your audit workpapers for efficient filings.

- AML and Economic Substance Regulation support to enhance compliance posture.

- Accounting and close support to help you prepare robust, audit ready financial statements.

- A practical compliance calendar tool and technology enabled workflows, so you never miss a deadline.

If you want to clarify your audit obligation, choose the right level of assurance, or plan a smooth audit this year, request a consultation with ADS Auditors.