Most businesses do not miss corporate tax deadlines because they ignore tax. They miss them because they treat the corporate tax return as a “one-month task” instead of a year-round workflow. In the UAE, that is risky. Corporate tax is now part of investor due diligence, bank credit reviews, and even some supplier onboarding.

This guide explains when corporate tax returns are due, how to calculate your exact due date, and how to build a timeline that keeps you compliant without last-minute stress.

The UAE rule that drives almost every corporate tax due date

In the UAE, the corporate tax return due date is linked to your tax period, which is usually the same as your financial year (for many companies, that is 12 months).

The key point is simple:

- Your UAE corporate tax return and payment are generally due within 9 months after the end of your tax period.

That “9 months after year-end” rule is the anchor you plan everything else around (closing your books, finalizing supporting schedules, and often completing your audit).

For official guidance, you can cross-check the corporate tax framework on the UAE Ministry of Finance website and practical filing guidance on the Federal Tax Authority site.

When Are Corporate Tax Returns Due? Common year-end examples (UAE)

The easiest way to avoid mistakes is to convert the rule into a table you can hand to your finance team.

| Your financial year end | Typical corporate tax return due date (9 months later) | What this means in practice |

| 31 Dec 2024 | 30 Sep 2025 | File and pay by end of September |

| 31 Mar 2025 | 31 Dec 2025 | File and pay by end of December |

| 30 Jun 2025 | 31 Mar 2026 | File and pay by end of March |

| 30 Sep 2025 | 30 Jun 2026 | File and pay by end of June |

If your first tax period is not a standard 12 months (this can happen for new businesses or when changing a year-end), your timeline can shift. In those cases, confirm the tax period shown in your Federal Tax Authority profile and align it with your finance close plan.

Deadlines you should track before the final due date

The filing deadline is only the last milestone. Strong compliance teams work backward from it.

1) Financial close deadline (internal)

If you close late, everything becomes expensive, audit fees rise, tax review becomes rushed, and mistakes become more likely.

A practical benchmark many growing SMEs use is

- Close bookkeeping within 30 days after year-end.

- Final management review by 60 days

This is not a legal rule; it is an execution standard that helps you meet the legal requirement.

2) Audit timeline (where applicable)

Many free zones, banks, investors, and shareholders require audited financial statements even when a statutory audit is not mandated.

If your audit starts too late, you may end up filing based on incomplete adjustments. This is one reason businesses work with experienced audit firms in UAE that understand both IFRS close and UAE corporate tax practicalities.

A useful planning lesson: treat the audit as a feeder into the corporate tax return, not as a separate project.

3) Tax computation and documentation readiness

The corporate tax return is not just a profit number. It is a position supported by documentation.

Build a standard “tax pack” early, including:

- Trial balance and final financial statements

- Fixed asset register and depreciation policy

- Related party schedules (especially if you have group entities)

- Key contracts that affect revenue recognition

- VAT reconciliations that support revenue integrity

This is where taxation consultancy services add real value: not by filling the form, but by reducing uncertainty and rework.

4) Cash planning for payment

In some countries, payment and filing dates are different, which creates confusion for multi-country groups. One practical advantage of the UAE model is that the payment deadline is typically aligned with the return deadline.

Strategic tip: build a “tax cash reserve” forecast that updates quarterly. If your business has seasonal revenue, do not wait until month eight to discover a cash gap.

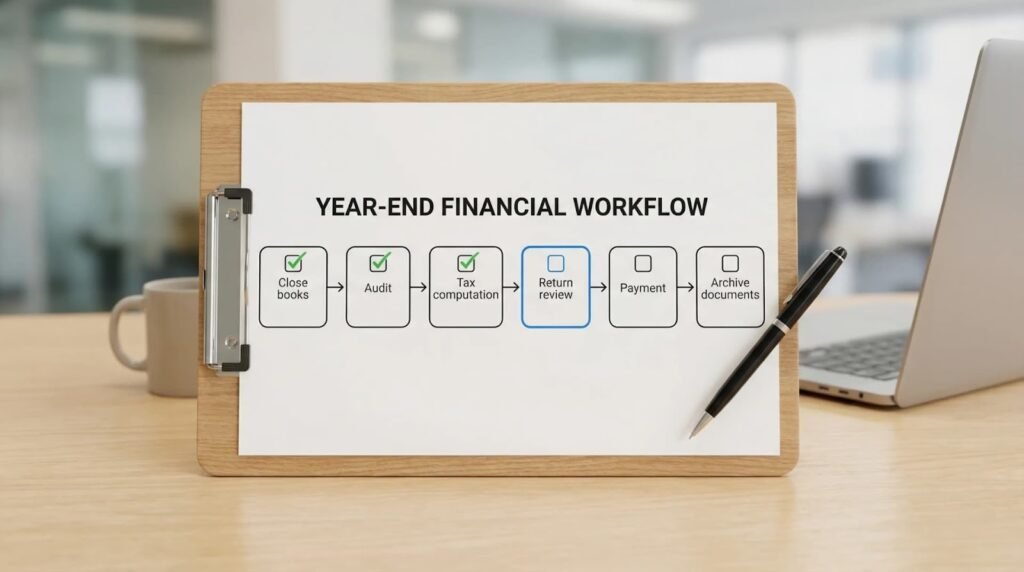

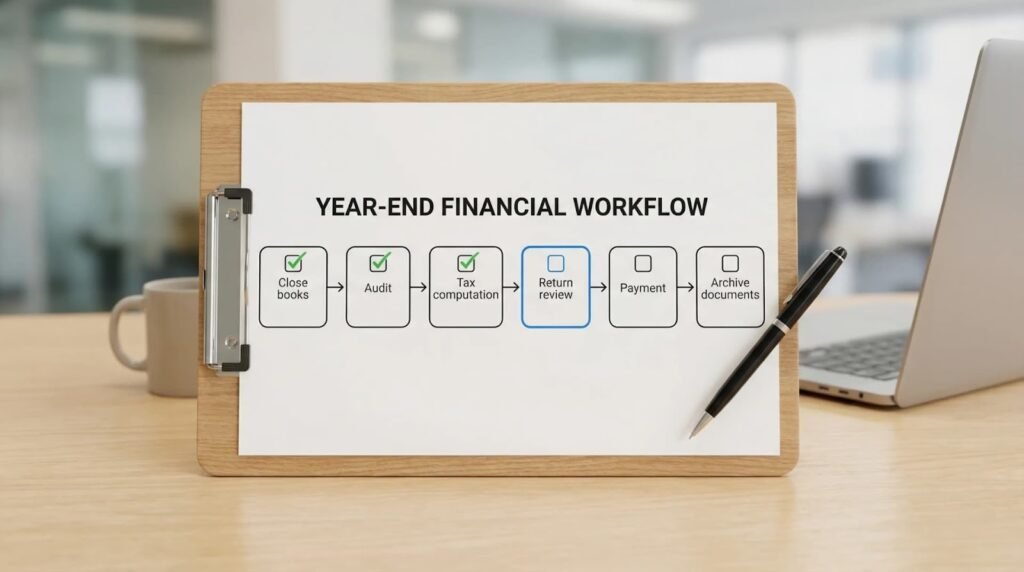

A simple “9-month countdown” plan you can adopt

Use this as a starting point, then tailor it to your size and complexity.

| Time after year-end | Focus | Output |

| Month 1 | Close books and reconcile major balances | Clean trial balance, reconciliations done |

| Month 2 to 3 | Review revenue and cost classification, VAT cross-check | Management accounts you trust |

| Month 4 to 6 | Audit (if required) and tax adjustments review | Final financial statements, adjustment log |

| Month 7 to 8 | Corporate tax return preparation and internal sign-off | Final draft return, payment plan |

| Month 9 | File and pay, then archive evidence | Submission proof, compliance file |

Investor and lender reality: deadlines affect valuation and deal speed

Businesses often ask, “If we are profitable and we pay later, does it matter?” In practice, yes, because compliance is a trust signal.

Here are two real-world patterns seen in transactions (using anonymized examples to protect confidentiality):

- Private equity minority investment in a Dubai services firm: During due diligence, the investor requested prior-year filings, audited financials, and reconciliations. The company had strong revenue growth but slow close processes. The investor reduced the upfront valuation and included a holdback tied to compliance cleanup because the risk was operational, not commercial.

- Bank facility renewal for a trading business: The bank’s credit team asked for updated financials and evidence of tax compliance as part of its annual review. The business was profitable but had delayed documentation. The facility renewal took longer and required additional conditions, which restricted working capital flexibility.

The lesson is simple: on-time filing is not only about avoiding penalties, it is also about protecting deal timelines and negotiating power.

Common deadline mistakes and how to avoid them

Mistake 1: Assuming your year-end is “automatically” the tax period

Many companies do change year-ends, restructure, or operate multiple entities. Always confirm the tax period in your FTA profile and keep corporate records consistent.

Mistake 2: Treating free zone status as “no filing needed”

Some free zone businesses may qualify for a 0 percent rate under specific conditions, but that does not automatically mean “no compliance.” In many cases, you still need proper records and submissions. If you operate across Emirates, align your approach across locations, including Corporate Tax Services Ras Al Khaimah if you have RAKEZ or other RAK entities.

Mistake 3: Leaving related party and transfer pricing work too late

Even for SMEs, related party transactions (management fees, intercompany loans, shared services) can take time to document and support.

How ADS Auditors can help you hit deadlines without rushing

If you want predictable compliance, the best fix is not “work harder in month nine.” It is building a system.

ADS Auditors supports businesses with Corporate Tax Services UAE, combining practical filing support with audit, accounting, and ongoing compliance planning. If you are looking for a tax consultant Dubai teams can rely on, or a corporate tax consultant in Dubai who can connect financial statements to tax positions and a structured timeline and review the lifecycle, they usually deliver the biggest improvement.

A good starting point is creating a shared compliance calendar and a repeatable tax pack, so every period becomes easier than the last.

Quick questions businesses ask about corporate tax return deadlines

When are corporate tax returns due in the UAE?

In general, the corporate tax return (and payment) is due within 9 months after the end of your tax period.

If my company has a 31 December year-end, what is my usual due date?

Typically, 9 months later, which is 30 September of the following year.

Do free zone businesses have to file a corporate tax return?

Many free zone businesses still need to maintain proper records and meet compliance requirements. Confirm your specific position based on your licensing, activities, and conditions.

What happens if we file late?

Late filing can trigger administrative penalties and creates reputational and financing risk. It also increases the chance of errors because the process becomes rushed.

Should we finalize the audit before preparing the corporate tax return?

If you are required to audit, it is usually best to align the tax computation with the audited numbers and documented adjustments.

Can we reduce risk by filing early?

Yes. Filing earlier (once numbers are final) gives you time to fix issues, prepare payment cash flow, and respond calmly if clarifications are needed.

If you want, share your financial year-end date and whether you are mainland or free zone, and we can map the exact 9-month timeline you should follow.