Filing your UAE VAT return is routine, but it is also high stakes. Errors can trigger penalties and cash flow strain, especially when import VAT, reverse charge and Emirate-wise reporting are involved. This step-by-step guide explains how to file VAT returns in UAE through EmaraTax, with checklists, trends to watch in 2025 and lessons learned from common review points we see at ADS Auditors.

What to know before you file

- VAT rate in the UAE is 5 percent on most taxable supplies.

- Returns are usually quarterly for SMEs, some businesses file monthly depending on FTA allocation.

- The deadline is 28 days after the end of each tax period, payment is due on the same date.

- Record retention is generally 5 years, for real estate related records it is 15 years.

| Topic | Key facts | Source |

| Mandatory VAT registration threshold | AED 375,000 taxable supplies in the last 12 months or next 30 days | Federal Tax Authority (FTA) |

| Voluntary registration threshold | AED 187,500 | FTA |

| Standard VAT rate | 5 percent | FTA |

| Filing deadline | 28 days after period end | FTA |

| Records retention | 5 years, 15 years for real estate records | Executive Regulations |

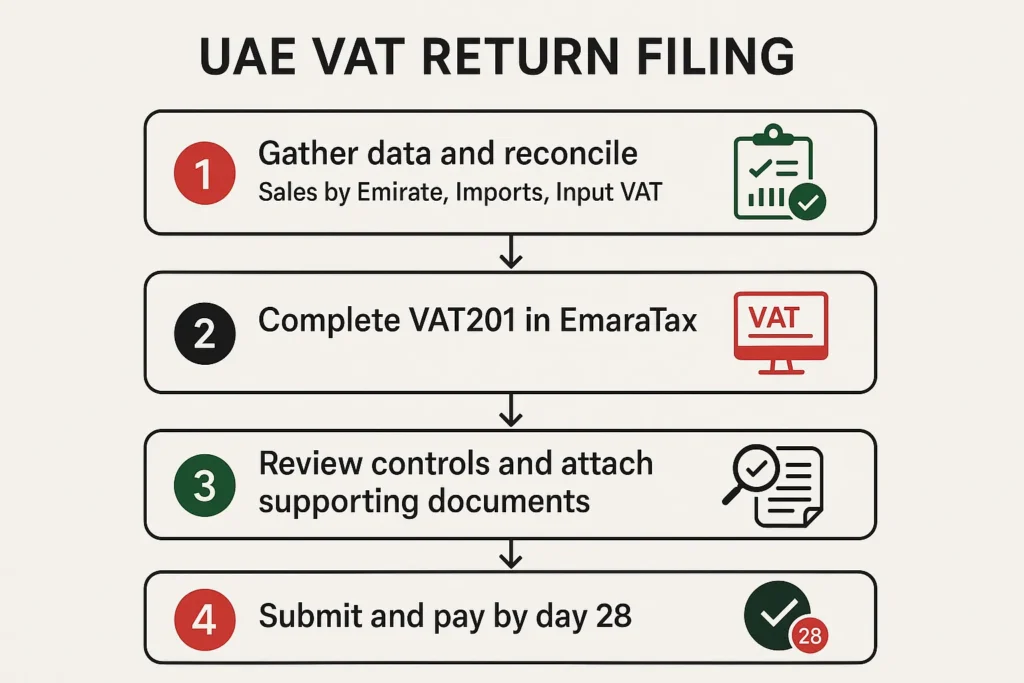

Step-by-step, filing a VAT return in EmaraTax

- Prepare your data

- Sales by Emirate, standard rated supplies must be split by Emirate, for example Dubai, Abu Dhabi, Sharjah, etc.

- Zero rated supplies, exports of goods outside the UAE and specific zero rated sectors such as certain healthcare and education.

- Exempt supplies, for example certain financial services and domestic passenger transport.

- Purchases and input VAT, ensure you separate recoverable and blocked input VAT, such as entertainment and personal motor vehicles.

- Imports, import VAT via customs and reverse charge on certain cross border services.

Tip, reconcile total revenue in your accounting system to the VAT return mapping. Unexpected gaps usually signal coding issues or missing invoices.

- Log in and access the VAT201 return

- Access EmaraTax through the FTA portal and open the VAT201 return for the relevant tax period.

- Confirm your Tax Registration Number and business details are up to date.

- Complete return sections accurately

- Standard rated supplies by Emirate, enter the taxable amount and output VAT for each Emirate. Use point of sale reports or billing system tags to allocate correctly.

- Zero rated and exempt supplies, report values even though no VAT is due. This helps the FTA assess your profile.

- Reverse charge supplies, include cross border services that fall under reverse charge. Declare output tax and the corresponding input tax if recoverable.

- Imports, check if your import VAT is pre populated from customs. If you use the VAT deferment account, ensure you declare the import value under reverse charge and claim eligible input VAT to net off.

- Adjustments, consider credit notes, bad debt relief if conditions are met and any corrections from prior periods that require a voluntary disclosure.

- Validate with quick control tests

- Output tax reasonableness, standard rated output VAT should roughly equal 5 percent of your standard rated supplies after rounding and adjustments.

- Input tax reasonableness, compare your input VAT to historical ratios versus cost of sales and overheads.

- Emirate allocation, confirm the Emirate wise sales split matches your operational footprint and POS reports.

- Imports, match customs declarations, Bill of Entry, to import VAT reported.

- Submit and pay by the due date

- Submit once your internal reviewer signs off. Keep a PDF copy of the VAT201 and the submission confirmation.

- Pay via the methods shown in EmaraTax. The FTA supports several payment options, including bank transfer to a generated account reference and card payments. Always reference the correct tax period to avoid misallocation.

- After filing, close the loop

- Post filing reconciliation, tie the VAT payable or refundable to your general ledger and bank statement.

- Refunds and carry forward credits, if you are in a net credit position, decide whether to carry forward or apply for a refund. Prepare supporting documents in case the FTA requests evidence.

- Archive records, keep tax invoices, contracts, customs documents and working papers for the statutory retention period.

2025 trends and what they mean for your VAT return

- EmaraTax integration with customs, more import VAT data pre population means mismatches are easier to spot. Expect targeted queries if you do not declare reverse charge correctly.

- Higher scrutiny on zero rated claims, exporters and businesses with frequent refunds face more detailed documentation checks. Maintain export evidence and proof of shipment.

- Data quality is a differentiator, companies that maintain clean Emirate tagging and consistent tax coding reduce review time and audit risk.

Example for a quarterly filer in 2025, Period Jan 1 to Mar 31, VAT return and payment due April 28, 2025. Adjust if your assigned tax period differs.

Common pitfalls we fix for clients

- Misallocated Emirate wise sales, consolidated sales reported under one Emirate even though outlets operate across multiple Emirates. Fix, drive Emirate tagging from POS or invoice address field, then reconcile to sales ledger.

- Ignoring reverse charge on cross border services, professional fees or software subscriptions from non resident suppliers are often overlooked. Fix, configure tax codes for reverse charge and automate journals.

- Over claiming input VAT on blocked items, entertainment, personal vehicle costs and employee benefits that do not meet recovery criteria. Fix, set blocked tax codes and periodic reviews.

- Customs and import VAT mismatches, duty deferment or import VAT under your TRN not reflected in the return. Fix, match Bills of Entry to EmaraTax and declare under reverse charge, then reclaim if eligible.

Mini case studies

- Retail and F&B chain, The business filed accurate total sales but misallocated by Emirate, which raised questions during a review. After implementing Emirate based POS mapping and a reconciliation checklist before submission, adjustments dropped and reviews closed faster.

- Export focused manufacturer, The company regularly claimed refunds but the export paperwork was incomplete. Standardizing the file checklist, commercial invoice, airway bill, customs exit proof and customer confirmation, reduced refund processing time and avoided follow up queries.

Strategic checklist before you press Submit

- Reconcile ledgers, revenue, VAT control and bank against the draft VAT201.

- Validate zero rated and exempt treatment with contracts and supporting evidence.

- Match imports in EmaraTax with customs records and reverse charge entries.

- Run a reasonableness test versus prior periods and business seasonality.

- Document everything, keep a dated working paper pack. It saves hours during any query.

If you have not registered yet, consider whether you must register for VAT or if voluntary registration fits your plans. Mandatory threshold is AED 375,000 and voluntary threshold is AED 187,500. ADS Auditors provides a VAT registration service for new and growing businesses, including Vat Registration in Dubai and across the UAE.

For official criteria, see the FTA guidance at tax.gov.ae.

FAQ

Who must register for VAT in the UAE?

Businesses that exceed the mandatory threshold of AED 375,000 in taxable supplies must register. Voluntary registration is possible from AED 187,500 to recover input VAT earlier.

How long do I have to file and pay after a tax period ends?

The deadline is 28 days after the end of your assigned monthly or quarterly period. Payment is due on the same date.

Do I have to split sales by Emirate in the VAT return?

Yes. Standard rated supplies are reported by Emirate. Use POS or billing system data to allocate correctly.

Can I reclaim VAT on staff entertainment or passenger vehicles?

These are typically blocked from recovery under the Executive Regulations, unless strict criteria are met. Review the regulations or seek advice before reclaiming.

How should I report import VAT?

If your import VAT is deferred under your TRN, declare it under reverse charge in the return and claim input VAT if eligible. Always reconcile to customs documents.

How long should I keep VAT records?

Keep VAT records for at least 5 years. For real estate related records, keep them for 15 years.

Work with ADS Auditors

Filing correctly every time comes down to clean data and disciplined review. ADS Auditors helps UAE businesses set up tax coding, automate reconciliations and file on time through EmaraTax. If you need to register for VAT, optimize your VAT position, or build a compliance calendar so you never miss day 28, reach out to ADS Auditors. Our team supports VAT services, corporate tax consultancy, accounting and compliance for companies across Dubai and the wider UAE.