Opening a corporate account is one of the first real tests of a company’s credibility in the UAE. If you are asking how to open a business bank account in Dubai, think of it as a compliance project with clear deliverables, timelines, and risk checkpoints. Below is a practical, 2025-ready playbook that blends regulatory expectations with real-world lessons from the UAE market, so you can move from application to activation with fewer surprises.

What banks evaluate before approving a business account

Banks in the UAE follow a risk-based approach to customer due diligence, guided by the Central Bank’s AML and CFT framework. Expect deeper questions if your business is new, your cross-border footprint is complex, or your industry is higher risk.

- Central Bank AML and CFT guidance

- UAE Corporate Tax, in effect since June 2023, may be relevant to your disclosures and documentation

- Economic Substance Regulations for relevant activities:

| Bank screening factor | Why it matters | What to prepare |

| Legal identity and good standing | Confirms the entity is valid and active | Trade license, MoA or AoA, certificate of incorporation, share certificates, registry extract, valid visas and Emirates IDs for signatories |

| Ultimate Beneficial Owners | Identifies who ultimately controls the company | UBO declaration, shareholding chart, passport copies, any holding or parent company documents |

| Business model and counterparties | Assesses commercial rationale and counterparties’ risk | One page business summary, sample invoices or contracts, supplier and customer lists, website, marketing deck |

| Geographic footprint | Higher scrutiny if you trade with sanctioned or high-risk jurisdictions | Country list of customers and suppliers, reason for routes, expected FX currencies |

| Source of funds and wealth | Validates capital origins for AML | Bank statements of shareholders or parent, audited accounts if available, proof of investment inflows |

| Substance in the UAE | Shows the business operates here, not only on paper | Office lease or flex-desk agreement, utility bill, payroll or employment visas, ESR assessment where applicable |

| Tax registration | Confirms compliance posture | VAT TRN if registered, Corporate Tax registration confirmation from the FTA if available |

| Expected activity volumes | Helps set limits and choose the right account tier | Forecasted monthly transactions, average balance, cash usage, card needs, FX flows |

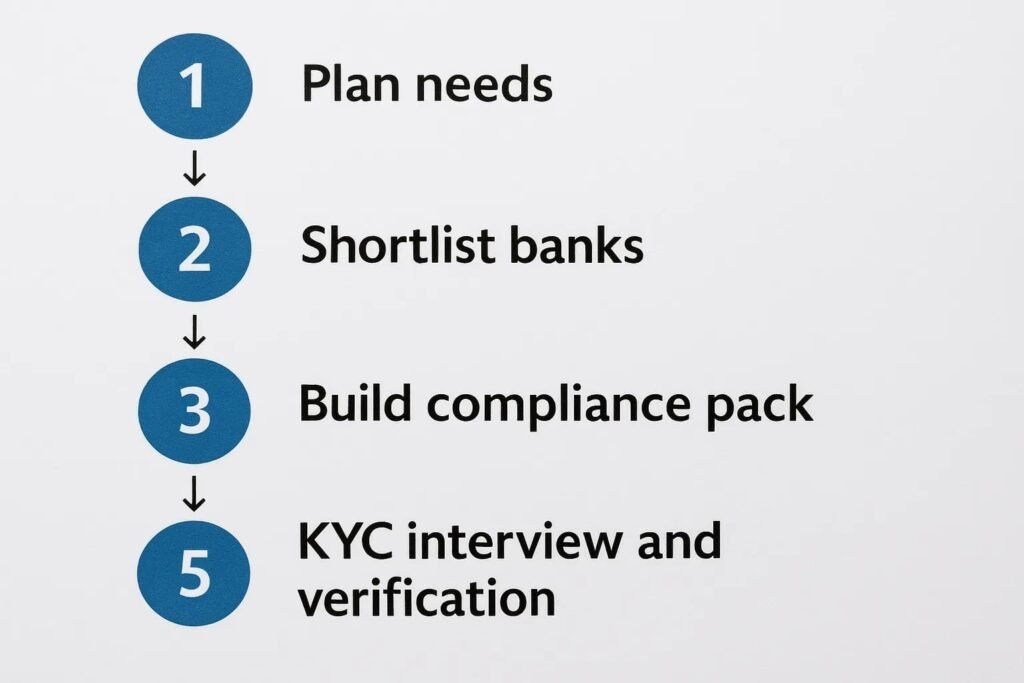

Step by step: Bank Account Opening in Dubai

1) Define your banking needs

Clarify the objective before you open an account at a bank in Dubai. Decide on transaction volumes, minimum balance comfort, currencies, international payments, checkbook needs, card issuance, and whether you need a relationship manager. If you expect heavy FX flows, prioritize banks with competitive multi-currency accounts and online FX tools. Digital-first SME platforms exist, while traditional banks fit more complex treasury needs.

2) Shortlist two to three banks

Compare account tiers, online banking capability, minimum balance policies, fee schedules, speed of onboarding, and support for your free zone or mainland activity. Many founders run with one primary account and one backup to diversify operational risk.

Tip: Banks increasingly leverage UAE PASS for digital identity verification where relevant. Learn more about UAE PASS

3) Build a complete compliance pack

A well-assembled submission accelerates approvals. Include the following core items.

- Company documents, trade license, MoA or AoA, share certificates, certificate of incorporation, board resolution authorizing account opening, registry extract if available.

- Shareholder and UBO documents, passport copies, Emirates IDs and visas for signatories, UBO declaration, full org chart if layered holding structures exist.

- Proof of UAE presence, lease or flex-desk agreement, recent utility bill in the company’s or landlord’s name, professional website and business email domain.

- Commercial proof, signed contracts or LOIs, sample invoices, supplier agreements, marketing deck, screenshots of storefronts or platforms if e-commerce.

- Financials and funds trail, proof of paid-up capital, recent bank statements from investors or parent company, audited accounts if available.

- Compliance confirmations, VAT and Corporate Tax registrations when applicable, ESR self-assessment for relevant activities, AML policy for regulated businesses.

Pro move, attach a one page “banking narrative.” Explain your business model, counterparties, countries, projected volumes, and why you selected the bank. Clear narratives reduce repetitive queries.

4) Submit, attend KYC interview, and handle site checks

Banks may interview the authorized signatory. Typical questions include source of funds, how you acquire customers, average ticket sizes, cash usage, and why Dubai is your base. For some profiles, banks may perform an office visit to verify substance. Physical presence of signatories is still common at final signature, even when portions of onboarding are digital.

5) Activate the account and set controls

Once approved, complete initial deposits, activate online banking, and configure approvals, user roles, daily limits, and alerts. Align your bookkeeping system so bank feeds reconcile to your accounting ledger from day one.

Document matrix by legal setup

| Document class | Mainland LLC | Free Zone FZ-LLC or FZE | Foreign Branch |

| Trade license and establishment docs | Required | Required | Required, plus parent’s articles and certificate of incumbency |

| MoA or AoA and share certificates | Required | Required | Not usually applicable, parent docs used |

| Board resolution for account opening | Required if multiple shareholders | Required if multiple shareholders | Required from parent board |

| UBO declaration and org chart | Required | Required | Required |

| Office lease or flex-desk | Usually required | Usually required | Usually required |

| Tax registration confirmations | If applicable | If applicable | If applicable for branch |

Notes, requirements vary by bank and zone. Always check the latest checklist before you open a business bank account.

What changed in 2024 and 2025

- Corporate Tax bedding in, The UAE’s federal Corporate Tax at 9 percent for standard taxable profits is now part of standard due diligence. Banks may ask whether you have registered or when you plan to, based on your activity and thresholds. See the Federal Tax Authority guidance.

- Stronger AML expectations, Licensed institutions continue to apply enhanced risk assessments and monitoring, especially for complex ownership chains and cross-border models. Reference the Central Bank AML and CFT page above.

- Digital identity and remote touchpoints, Banks increasingly use digital tools for parts of onboarding, while final signatory verification often remains in person for corporate accounts.

Lessons from the field, how founders succeed

- Build substance early, Even if you start lean, secure a compliant lease arrangement and a business email domain, and publish a credible website. It signals operational reality.

- Answer sanctions and geography questions up front, Provide a country list of suppliers and customers, plus your screening steps. This lowers friction with compliance teams.

- Show the money trail, Prepare a clear path from shareholders’ wealth or parent company cash to your UAE entity. Include statements, investment agreements, and capitalization proofs.

Illustrative scenarios based on common UAE cases,

- New media agency in a free zone, Approval followed quickly after the founders provided three client LOIs, a small retainer contract, and proof of a serviced office. The initial bank query focused on cash usage, resolved by committing to cashless collections.

- Cross-border e-commerce startup, Delays cleared when the team submitted 3PL and payment gateway agreements, screenshots of marketplace storefronts, and a forecast of FX flows by currency. The bank set sensible transaction limits aligned to the forecast.

Common pitfalls to avoid

- Thin or inconsistent documentation, Mismatches between license scope, website content, and contracts cause rework.

- No UBO clarity, In layered structures, missing parent company docs stop the process.

- Waiting on tax matters, If you are in scope, plan Corporate Tax registration early and keep VAT TRN handy when applicable.

- Only one bank in your plan, Keep a secondary option ready if your industry or geography profile is tight.

Indicative readiness checklist you can use today

| Readiness item | Owner | Status |

| One page banking narrative prepared | Founder | |

| Updated license and MoA on file | Company secretary | |

| UBO chart and declarations | Legal | |

| Office lease or flex-desk proof | Admin | |

| Contracts, invoices, marketing deck | Sales | |

| Proof of funds and bank statements | Finance | |

| VAT and Corporate Tax confirmations if applicable | Tax | |

| ESR assessment for relevant activities | Compliance |

Where ADS Auditors fits in

If you want to open a business bank account without losing weeks to back-and-forth, bring in a partner that speaks both compliance and commercial. ADS Auditors supports Bank Account Opening in Dubai, plus company formation, corporate tax, VAT, AML, ESR, and accounting, so your submission aligns with what banks actually require. Our team can,

- Map your ownership and create a banker-friendly UBO pack

- Draft a crisp banking narrative and organize commercial evidence

- Coordinate with your chosen bank and prepare you for KYC interviews

- Align tax registrations and ESR posture to reduce compliance friction

- Implement a simple compliance calendar so renewals and filings do not jeopardize your account

Ready to move from research to approval, Talk to ADS Auditors and get a practical plan tailored to your sector and free zone or mainland setup.