If you run a business or invest in the UAE, you have probably wondered what a tax consultant actually does beyond filing a return. In short, a good consultant such as an ads management tax consultancy translates complex rules into practical decisions, sets up processes so your filings are accurate and on time, and spots strategy opportunities that protect cash flow and reduce risk..

What does a tax consultant do, in one minute

A tax consultant helps you understand the law, design an efficient structure, keep clean records through strong tax accounting, file correctly, and defend your position if the tax authority asks questions. In Dubai, that spans corporate tax, VAT, transfer pricing, economic substance, and anti-money-laundering touchpoints that sit across finance, legal, and operations.

Roles and responsibilities across the year

- Strategic planning, choice of legal entity and free zone use, profit repatriation, dividend and exit considerations.

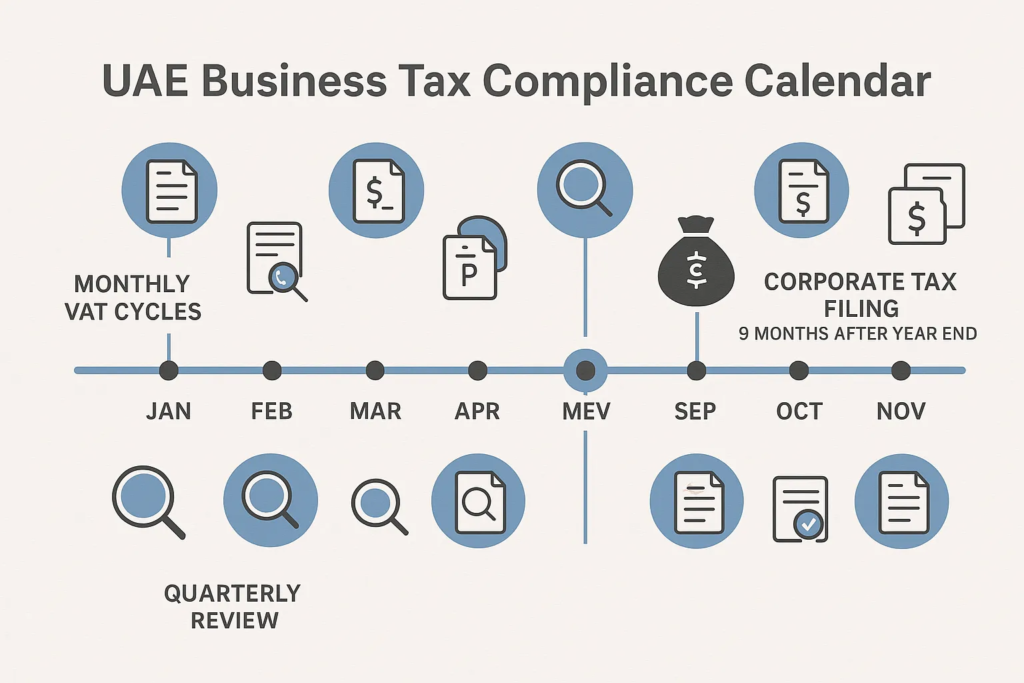

- Compliance architecture and controls, mapping transactions to tax treatments, documenting policies, building a compliance calendar.

- Filing, VAT returns monthly or quarterly, corporate tax return within nine months of year end, payment management, reconciliations and disclosures.

- Transfer pricing and group policies, intercompany pricing, documentation, master file and local file where required, benchmarking.

- Economic Substance and AML coordination, assessing relevant activities, documenting substance, aligning with KYC, risk assessments.

- Audit readiness and dispute support, responding to Federal Tax Authority information requests, voluntary disclosures, audit defense.

- Technology enablement, data extraction from accounting systems, consistency checks, analytics for anomaly detection, and preparing e ready workpapers.

The Dubai context, key rules at a glance

The UAE corporate tax regime went live for financial periods starting on or after 1 June 2023. VAT has applied since 2018. The table below summarizes essentials that drive your tax calendar.

| Topic | Snapshot for UAE businesses | Reference |

| Corporate tax rate | 9 percent headline rate on taxable income above AED 375,000, with reliefs and adjustments defined in law | UAE Ministry of Finance, Corporate Tax |

| Corporate tax filing deadline | Return and payment generally due within 9 months after the end of the tax period | UAE Federal Tax Authority |

| Free zone regime | Qualifying Free Zone Persons may access a 0 percent rate on qualifying income if strict conditions are met | UAE Ministry of Finance |

| Small Business Relief | Available for eligible entities with revenue not exceeding AED 3 million for specified periods through 2026 | UAE Ministry of Finance |

| VAT | Standard rate 5 percent, returns monthly or quarterly, due by the 28th day after the tax period end | UAE Federal Tax Authority |

| Transfer pricing | Arm’s length principle, documentation requirements aligned with OECD guidance | OECD TP Guidelines |

A consultant ensures you meet these rules with the least friction, and that you only pay what you owe, nothing more.

Where the value shows up, data driven levers

- Cash flow, aligning VAT input claims with supplier data and payment terms to avoid blocked recoveries and late payment costs.

- Accuracy, automated reconciliations of sales, GL, and VAT returns to reduce error risk that can trigger FTA queries.

- Structure optimization, selecting or maintaining free zone qualification where appropriate and practical, segmenting qualifying and non qualifying income.

- Governance, documented policies and workpapers that withstand audit scrutiny, cutting investigation time.

- Scalability, clean data and processes so your finance team spends more time on operations and less on rework.

Illustrative investor and founder scenarios

These examples are simplified and for education. They show how tax consultancy services can change outcomes without inventing aggressive positions.

- Free zone exporter, qualifying income assessment: A mid market manufacturer in a Dubai free zone sold mostly to foreign customers. A consultant mapped income streams, identified qualifying activities, and set up transaction level tagging. Lesson learned, segmentation is essential, because one mixed contract can compromise benefits if not separated properly.

- E commerce SME, VAT place of supply: A startup shipping to GCC customers misapplied place of supply on certain cross border sales. The adviser reconfigured the ERP tax codes and documented logic per FTA guidance. Lesson learned, systems, not spreadsheets, should drive VAT logic if you scale.

- Family investment vehicle, participation exemption check: A UAE holding company planned to exit a minority shareholding. The tax adviser stress tested participation exemption conditions and documented beneficial ownership and holding period evidence. Lesson learned, exit planning starts months before signing, not at closing.

- Group services, transfer pricing: A regional group centralised IT and HR services in Dubai. The consultant prepared a policy, benchmarked margins, and implemented intercompany agreements. Lesson learned, pricing policy plus documentation reduces the risk of adjustments later.

Build, buy, or hybrid, choosing your operating model

Many finance leaders ask whether to hire in house, outsource to a firm, or blend both. Here is a quick comparison for decision making.

| Model | Best for | Strengths | Watch outs |

| In house | Large, stable transaction volumes | Control, embedded knowledge | Hard to keep up with frequent rule changes, hiring and retention costs |

| Outsourced tax consultancy services | SMEs to mid market, fast movers | Specialist expertise on tap, predictable scope | Requires clear data handover and SLAs |

| Hybrid | Growing businesses, groups | Internal owner plus external specialists for complex topics | Needs strong governance to avoid gaps |

If you are seeking tax consultancy services in Dubai, the hybrid model often wins early, pairing a lean finance team with an external adviser for corporate tax, VAT, and transfer pricing peaks.

2025 trends we are watching

- First full corporate tax cycles, many businesses will file their first full year return in 2025, which means more FTA queries focused on documentation quality.

- Free zone scrutiny, greater emphasis on conditions for qualifying free zone income and on proper segmentation in accounting systems.

- Data led enforcement authorities globally are using analytics to surface anomalies. Clean reconciliations and consistent coding are becoming non negotiable.

- Cross border alignment, groups with international footprints should monitor minimum tax and transparency developments even if local implementation timelines vary.

How to evaluate a tax consultancy in Dubai

- Credentials and standing, local regulatory understanding, and experience with the FTA process.

- Sector fit, portfolio of similar businesses and transaction patterns to yours.

- Transfer pricing and ESR capability, not only return filing but policy design and documentation.

- Technology approach, ability to work with your accounting stack and deliver repeatable workpapers.

- Service model and access, named points of contact, clear scopes, and response times.

How ADS Auditors fits in

ADS Auditors supports founders, CFOs, and investors with corporate tax consultancy, VAT services, accounting, company formation, AML and ESR support, and a practical compliance calendar approach. The team focuses on tailored, technology enabled advice that is easy to operate day to day. If you need end to end tax consultancy in Dubai, from setup to ongoing filings and transaction support, ADS Auditors can help you move quickly and stay compliant without overbuilding your back office.

Talk to ADS Auditors to review your structure, deadlines, and documentation before peak filing season.

FAQ

What does a tax consultant do in the UAE?

They interpret the law for your specific business, design an efficient structure, set up controls and calendars, prepare and file VAT and corporate tax returns, handle transfer pricing and economic substance questions, and support you during any FTA queries.

When should a startup hire a consultant?

Engage before your first VAT registration or corporate tax period, and definitely before a funding round, free zone application, or cross border expansion so you avoid rework.

What is the difference between an accountant and a tax consultant?

Accountants focus on bookkeeping and financial statements. Tax consultants turn those numbers into the correct treatments, filings, and strategies, and they maintain documentation to defend your position.

What documents are needed for UAE corporate tax filing?

IFRS based financial statements, trial balance, supporting schedules for adjustments, related party disclosures, and any transfer pricing documentation required by thresholds.

Can a consultant guarantee tax savings?

No. A credible adviser improves accuracy, reduces risk, and identifies compliant planning opportunities, but outcomes depend on your facts and timely implementation.If you want a clear plan for corporate tax and VAT, along with a compliance calendar your team can follow, connect with ADS Auditors, an ads management tax consultancy. It is a practical first step that brings control, speed, and confidence to your tax function.