Stepping into audit is one of the fastest ways to understand how businesses really work. The audit assistant sits at the heart of that learning curve, helping plan and execute procedures that give stakeholders confidence in a company’s numbers, especially within an audit firm in UAE. If you are exploring an entry point into assurance, or you want to understand who actually tests your invoices and inventory, this guide breaks down the role, the skills you need and the career path, with context for working in Dubai and across the UAE..

What an audit assistant actually does

An audit assistant supports the engagement team across the full audit lifecycle, delivering audit services Dubai businesses rely on. The work is structured, evidence driven and guided by the International Standards on Auditing issued by the International Auditing and Assurance Standards Board and financial reporting frameworks like IFRS..

Before the audit begins, pre‑engagement and planning support

You help the team prepare to audit efficiently and independently. Typical tasks include compiling initial client information, assisting with KYC and AML checks, mapping trial balances into working papers, sending prepared-by-client (PBC) request lists and scheduling walkthroughs of key processes. You may draft preliminary analytical reviews and help set up materiality thresholds under supervision.

During fieldwork, tests and evidence

This is where most of your time is spent. Audit assistants perform and document tests of controls and substantive procedures. You vouch transactions to source documents, trace from source to ledgers, test revenue and expense cut off, recalculate provisions, confirm balances with banks or customers, attend inventory counts and perform data analytics on ledgers to spot anomalies. Every step is documented clearly, cross referenced and reviewed by seniors.

Wrap up and reporting

As the team finalizes findings, you clear review points, tie out the financial statements to the lead schedules, draft management letter observations and ensure the audit file meets quality control requirements. You also help compile adjustments agreed with management.

| Responsibility | Evidence you produce | What success looks like |

| PBC coordination and file setup | Up to date request tracker, organized folders, mapping of trial balance to leads | The team can start testing without delays, version control is clear |

| Walkthroughs and control testing | Narratives or flowcharts, test sheets, exceptions log | Controls are documented, tested and exceptions are clearly supported |

| Substantive testing | Tick marked workpapers, sampling sheets, vouching and tracing, recalculation files | Conclusions are supported, samples are appropriate, no gaps in documentation |

| Analytics and ratios | Trend analyses, reasonableness checks, variance explanations | Unusual movements are explained or flagged for further work |

| Reporting support | Tie out checklist, disclosure checklist, management letter drafts | Financials agree to leads, disclosures are complete, points are concise and useful |

Core skills that make an audit assistant stand out

Technical fundamentals

- Understanding of IFRS basics, recognition and measurement for revenue, receivables, inventory, PPE, leases and provisions.

- Familiarity with ISAs and the audit risk model, planning, materiality, sampling and documentation requirements. See IAASB guidance on ISAs at the IAASB website.

- Solid Excel, especially PivotTables, XLOOKUP or INDEX MATCH, SUMIFS, TEXT functions, conditional formatting and basic macros for repetitive tasks.

Digital and data proficiency

- Comfort with audit management software and e-working papers, plus secure data rooms and e-confirmations.

- Power Query and CSV hygiene for clean data imports. Introductory visualization skills in Power BI or similar can help explain findings.

- Thoughtful use of automation and AI for drafting checklists or summarizing standards, while following your firm’s confidentiality and data handling policies.

Soft skills and professional behavior

- Professional skepticism and attention to detail, you verify, you do not assume.

- Clear communication with clients and your team, especially when requesting evidence or explaining exceptions.

- Time and priority management across multiple sections of the file, knowing when to escalate issues early.

UAE specific regulatory awareness

- VAT has applied in the UAE since 2018, so VAT treatments and reconciliations often feature in audit work. The Federal Tax Authority maintains guidance at the FTA website.

- The UAE Corporate Tax regime applies to financial years starting on or after 1 June 2023, so you will often assist seniors with deferred tax workings and disclosures. See foundational materials at the UAE Ministry of Finance Corporate Tax page.

- Awareness of anti money laundering and economic substance rules, auditors frequently consider compliance impacts when assessing risk

Tools you will touch early in your career

- Excel and Google Sheets for sampling, analytics and recalculations.

- Audit working paper platforms, document request tools and secure data rooms.

- E confirmation platforms for banks and receivables.

- Data extraction from accounting systems and ERPs, CSV exports and basic SQL or Power Query can save you hours.

The best audit assistants build small, reusable templates, a sampling workbook, a bank reconciliation tick mark key, a tie out checklist and share them with the team.

Qualifications, courses and certifications

A bachelor’s degree in accounting, finance, or a related discipline is typically required to enter the field. Internships or training programs help you convert theory into audit documentation skills.

Professional credentials signal commitment and accelerate progression. Choose based on your target specialization and mobility goals.

| Credential | Focus | Best for |

| ACCA | IFRS oriented financial reporting and audit | Global mobility across audit and finance |

| CPA (US) | US GAAP and auditing, strong for multinational exposure | Roles touching US reporting or global firms |

| ICAEW ACA | Deep training in audit, reporting and business | UK and international practice environments |

| CA (India, Pakistan, etc.) | Rigorous professional pathway with articleship | Strong audit fundamentals and regional mobility |

| CIA | Internal audit, controls, risk | Moving into internal audit and risk |

Add targeted UAE courses, VAT and Corporate Tax refreshers, AML awareness and IFRS updates. For up to date standards, refer to the IFRS Foundation and the UAE Ministry of Finance Corporate Tax hub.

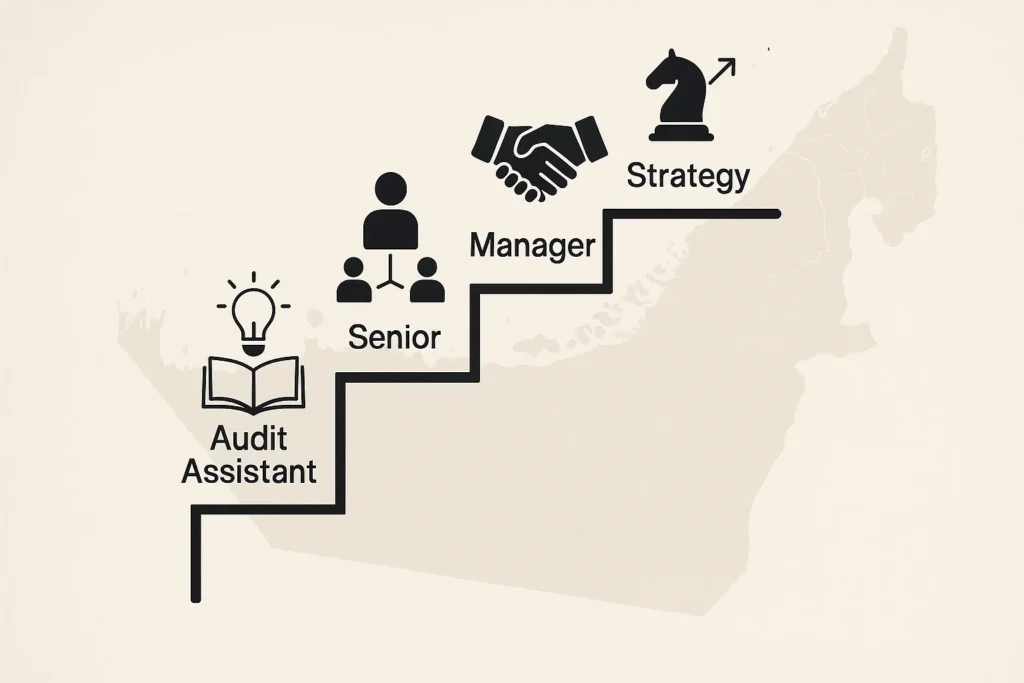

Career path and progression

Early years are about mastering documentation and testing, then coaching others. A common trajectory looks like this:

- Audit assistant or associate, learn testing, documentation and client handling.

- Senior, plan sections, review assistants’ work and lead small teams.

- Supervisor or assistant manager, own workstreams, manage timelines and quality.

- Manager and senior manager, manage engagements and portfolios, lead client relationships and shape risk assessments.

- Director or partner, set strategy, sign opinions and build practice areas.

Many professionals branch into related roles after a few years, internal audit, risk and controls, financial planning and analysis, corporate accounting, or tax and advisory. Compensation depends on firm size, qualifications and performance. To benchmark current market ranges in Dubai and the wider UAE, consult resources like Glassdoor and Payscale. Firms may also support exam fees and study leave, which can be a meaningful part of your package.

A day in the life of an audit assistant

No two days are identical, but the rhythm is steady.

Morning, check your PBC tracker, follow up with clients and plan your testing for the day. Prioritize sections that unblock teammates, for example revenue samples that a senior needs for analytical review.

Midday, perform tests, document results and resolve exceptions. Keep your working papers clean, file naming, cross references and tick marks matter. Ask for a quick review mid afternoon to catch issues early.

Late afternoon, update status in the team meeting, clear review notes and prepare tomorrow’s sample pulls and requests. During the busy season, expect accelerated timelines and more client meetings.

How businesses in Dubai work with audit assistants

For companies, the audit assistant is often your most frequent contact, including when coordinating with teams handling VAT registration services in Dubai and other locations. Clear and timely responses to their PBC requests reduce disruption to your finance team and help your auditors deliver on time. Prepare reconciliations and supporting schedules and designate a single point of contact for clarification.

If you do not have the internal capacity to keep up with changing standards, VAT and the UAE Corporate Tax environment, partnering with an external team that blends technical depth with technology makes a real difference.

ADS Auditors serves clients in Dubai and internationally with audit, corporate tax, VAT, accounting, AML, ESR support, company formation and more. The firm emphasizes personalized service, a practical compliance calendar approach and technology integration, so your audit runs smoother and your team stays focused on the business.

To discuss your audit or compliance needs, connect with the team at ADS Auditors.

Practical tips to get started as an audit assistant

- Build a compact IFRS and ISA cheat sheet, one page per standard you encounter most frequently.

- Create a clean sampling template and a bank reconciliation tie out checklist you can reuse across clients.

- Practice vouching on public company reports, pick a listed company, rebuild two or three analytical ratios and write a short conclusion.

- Keep a simple compliance calendar that tracks key client reporting dates, it helps you anticipate evidence requests and deadlines.

- Reflect after each engagement, what slowed you down, what template would have saved time and what questions should you ask earlier next time.

Key takeaways

- In order to ensure that audits are completed on schedule and according to standards, audit assistants collect evidence and document it.

- Success is built on a solid foundation in IFRS, ISAs and Excel as well as clear communication and skepticism.

- Understanding VAT, the new corporate tax system and AML and ESR issues improves your reputation in the UAE.

- In addition to concentrated UAE tax education, certifications such as ACCA, CPA and ACA hasten advancement.

- Organized PBC answers, prompt reconciliations and an outside partner that integrates technology, people and process all help businesses.

- Speak with the professionals at ADS Auditors about creating a more seamless audit and robust compliance posture whether you are a finance leader getting ready for an audit or if you want to learn more about the individuals behind the process.

If you are a finance leader preparing for an audit, or you want to understand the people behind the process, talk to the experts at ADS Auditors about building a smoother audit and stronger compliance posture.