Introduction

What Is Tax Accounting? The question seems simple, yet the answer shapes every dirham you pay to the Federal Tax Authority. Understanding What Is Tax Accounting equips company owners and salaried professionals alike to plan ahead, avoid penalties and unlock legal savings. In this guide, we break down the process, explain key principles and show how expert help from a qualified tax accountant can transform compliance into a competitive advantage.

Defining Tax Accounting

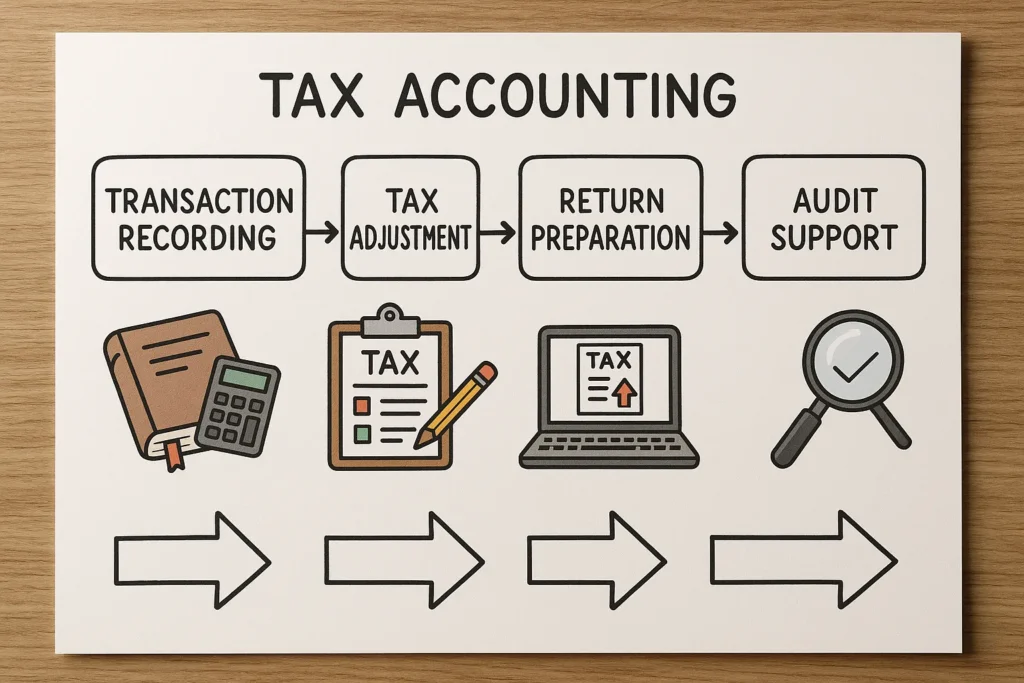

What Is Tax Accounting in its purest form? It is a specialised branch of accountancy that records, analyses and reports transactions specifically for tax purposes. Unlike general bookkeeping, tax accounting focuses on rules laid out in UAE Corporate Tax Law, Cabinet Decision No. 49 for VAT and international standards such as IFRS.

The discipline relies on two main pillars:

- Identification of taxable income and deductible expenses.

- Timely preparation and filing of returns with accurate supporting evidence.

Companies in Dubai often outsource these tasks to professional firms providing tax accounting services. When handled well, the company not only meets legal deadlines but also benefits from precise cash flow forecasting and better decision-making. Individuals, meanwhile, gain clarity on salary income, rental proceeds and capital gains that could trigger a tax obligation in other jurisdictions.

Why Tax Accounting Matters for Businesses

For organisations operating in the UAE’s fast-growing economy, mistakes in tax filings can result in hefty fines or even criminal liability. The Federal Tax Authority can levy penalties reaching AED 50,000 for repeated violations. A robust accounting system removes that risk and offers three additional pay-offs:

- Strategic Planning – Accurate numbers reveal the true cost of expansion, enabling CEOs to decide whether to set up a new branch onshore or in a free zone.

- Investor Confidence – Audited tax records assure shareholders that management adheres to governance standards.

- Cost Optimisation – Correctly classifying expenses as deductible lowers the company’s effective tax rate.

Need help building such a system? Explore our comprehensive accounting services designed for SMEs and large enterprises.

Tax Accounting for Individuals in the UAE

Although personal income is not taxed domestically, many expatriates remain subject to home-country rules. A qualified tax accountant examines double taxation treaties, residency tests and foreign tax credits to determine whether you must file abroad. Renting out property? Capital gains on a villa sold in Dubai may appear tax-free locally yet attract tax back home if not structured well.

Common individual scenarios that demand professional advice include:

- Remote employees working for overseas companies.

- High-net-worth investors with global share portfolios.

- Entrepreneurs drawing dividends from UAE free-zone entities.

Our team regularly publishes practical tips on the ADS Auditors blog to help residents navigate cross-border obligations.

Key Principles and Standards

What Is Tax Accounting without clear guidelines? The UAE mandates that taxable entities keep records for at least seven years, maintain invoices in Arabic and reconcile VAT ledgers within 15 days of each tax period. Businesses must also follow IFRS or another recognised framework when preparing statutory accounts.

Below is a snapshot of essential principles:

| Principle | Business Impact | Compliance Tool |

| Accrual Basis | Matches income and expenses to the period earned | ERP integration with VAT services |

| Substance over Form | Disallows artificial transactions created solely for tax benefit | Quarterly management reviews |

| Arm’s Length | Governs pricing between related parties | Transfer-pricing file prepared by tax accounting services |

Adhering to these rules builds a bulletproof audit trail and reduces the time spent responding to FTA queries.

Choosing the Right Tax Accountant

Selecting professional tax accounting services is more than comparing fees. Look for:

- Recognised credentials such as ACCA, CPA, or UAECA.

- Proven expertise in your sector, whether construction, fintech, or hospitality.

- Digital capabilities that automate data capture and generate real-time dashboards.

- End-to-end scope covering VAT, excise, ESR and corporate tax.

ADS Auditors, for example, integrates an AI-driven compliance calendar that reminds clients of every statutory deadline. This proactive approach eliminates last-minute stress and ensures filings pass first-time review.

How ADS Auditors Supports Your Compliance

As award-winning auditors in Dubai, our firm delivers scalable solutions ranging from book clean-ups to continuous outsourcing. Services include:

- Corporate tax consultancy to interpret the latest ministerial decisions.

- End-to-end VAT return preparation aligned with your ERP.

- Risk assessments under anti-money-laundering regulations.

- Company formation and bank account opening to launch new ventures rapidly.

Clients also gain access to a secure portal that stores signed returns, audit reports and correspondence with the FTA, creating one source of truth for authorities and investors alike.

Frequently Asked Questions

What Is Tax Accounting different from financial accounting?

Financial accounting targets external stakeholders by presenting overall profitability, while tax accounting focuses solely on computations required for government filings.

Do freelancers need a UAE tax return?

At present, personal income is not taxed locally, but freelancers registered as sole establishments may have VAT obligations if turnover exceeds AED 375,000.

How often must corporate tax be filed?

The UAE corporate tax regime requires an annual return within nine months of the financial year-end, alongside quarterly or bi-monthly VAT submissions where applicable.

Take the Next Step

Still unsure whether your ledgers meet FTA standards? Schedule a discovery call with ADS Auditors. Our specialists will explain what tax accounting means for your situation and craft a customised roadmap to full compliance.

Book your consultation today and turn regulatory challenges into strategic wins.