Value Added Tax (VAT) has been part of the UAE’s fiscal landscape since January 2018, yet many SMEs still treat “VAT filing” as a back-office chore instead of a strategic finance function. That mindset can be costly: in 2023 alone, the Federal Tax Authority (FTA) issued more than AED 1.1 billion in administrative penalties, with late or incorrect returns topping the list of violations (FTA Annual Report 2024).

VAT filing explained in plain English

VAT filing is the process of preparing and submitting a periodic return to the FTA that declares:

- Output VAT you collected on taxable supplies.

- Input VAT you paid on eligible purchases.

- The net amount payable (or refundable) for the period.

For most UAE companies the filing period is quarterly, though businesses with annual supplies above AED 150 million file monthly. Returns must reach the FTA and any tax due must be settled within 28 days after the period ends.

| Filing frequency | Annual taxable supplies | Return due date |

| Monthly | > AED 150 m | 28 days after month-end |

| Quarterly | ≤ AED 150 m | 28 days after quarter-end |

Missing those deadlines can quickly erode cash flow:

| Administrative penalty | Amount |

| Late filing | AED 1,000 (1st offense) / AED 2,000 (subsequent) |

| Late payment | 2 % of unpaid tax for the 1st month + 4 % Subsequent month |

Source: Federal Tax Procedures Law No. 7 of 2017, Cabinet Decision No. 40 of 2017.

Why VAT filing matters far beyond compliance

- Direct impact on margins

Input VAT recovery can improve EBITDA by 3-5 % for service-heavy SMEs, according to a 2024 survey of 350 UAE businesses by the Dubai Chamber of Commerce. Delayed or inaccurate recovery locks up working capital you could deploy for inventory, salaries, or expansion. - Credibility with investors and banks

Private-equity term sheets increasingly include “clean tax compliance” as a condition precedent. ADS Auditors regularly sees asset managers negotiate valuation haircuts of up to 1.5x EBITDA when a target has unresolved VAT exposures. - Data for strategic decision-making

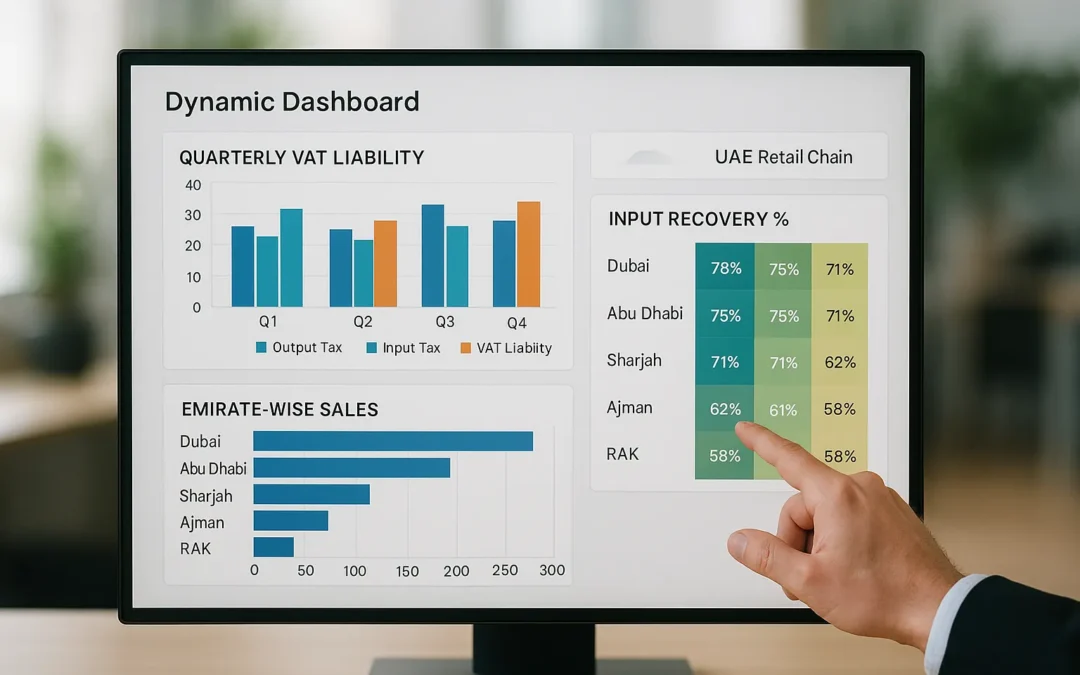

VAT return data broken down by product line and emirate can spotlight high-margin segments, customer geography shifts, and seasonal demand patterns. When paired with a cloud accounting stack, quarterly VAT numbers become a free analytics feed.

Gateway to corporate tax readiness

The UAE’s 9 % federal corporate tax went live in June 2023. Companies that mastered VAT reporting already have standardized chart-of-accounts, tax codes, and documentation controls the same foundations corporate tax compliance requires. Think of VAT filing as “training wheels” for the broader tax regime.

Common pitfalls ADS Auditors uncovers during VAT reviews

| Pitfall | Typical consequence | Quick fix |

| Mis-classified zero-rated exports | Under-payment + penalties | Revisit place-of-supply tests; obtain commercial export docs |

| Unreconciled POS vs. ERP sales figures | Audit trail gaps | Integrate POS with accounting software; run monthly tie-outs |

| Claiming input VAT on blocked items (e.g., entertainment) | Disallowed deduction | Update purchase approval matrix with VAT flags |

| Ignoring reverse-charge on imported services | Tax shortfall | Configure ERP to auto-post RCM entries |

Trends reshaping VAT filing in the UAE

- E-invoicing on the horizon

The FTA completed its pilot for a national e-invoice platform in Q3 2024. Mandatory phasing is expected to start mid-2026, mirroring Saudi Arabia’s ZATCA model. Early adopters will enjoy real-time validation and reduced audit risk. - AI-driven audits

The authority’s Risk Engine 2.0 now cross-matches customs data, ESR notifications, and bank remittances. Companies with recurrent discrepancies trigger an automated desk audit within 24 hours. - Sector-specific guidance

New Public Clarifications on e-commerce, digital assets, and healthcare issued in 2025 narrow grey areas. Businesses must update tax codes or risk

Strategic advice for CFOs and founders

- Automate the source, not the spreadsheet

Instead of bolting macros onto Excel, integrate your ERP or cloud ledger (e.g., Zoho, Xero) directly with the FTA e-Services portal via API once available. This slashes manual touchpoints and error rates. - Run a pre-submission “VAT health check”

ADS Auditors proprietary checklist flags 50+ risk points from duplicate TRNs to anomalous margin swings before the return is uploaded. Building a similar internal review cycle can cut penalty exposure by 80 %. - Treat refunds as a financing line

If your business is consistently in a refund position (common in capex-heavy logistics or exporters), file on a monthly basis even if not mandated. A 45-day refund cycle on AED 2 million of input VAT equates to an annualised cash yield of ~7 %. - Benchmark your effective VAT rate

Compare net VAT payable as a percentage of revenue against sector medians. ADS Auditors’ 2025 Retail Tax Index shows supermarkets average 2.9 %, while fashion boutiques average 3.8 %. Deviations often signal coding errors or pricing strategy gaps. - Leverage a corporate tax consultant for synergy

Engaging one advisory team for both VAT and corporate tax streamlines data collection and interpretation. Cross-functional insights such as aligning transfer-pricing policies with VAT place-of-supply rules can unlock additional savings.

Real-world impact: two investor-backed case studies

- Series B e-commerce platform

Problem: Frequent stock imports from the EU triggered reverse-charge VAT that finance overlooked.

Intervention: ADS Auditors mapped customs codes to accounting entries and automated RCM postings.

Result: AED 1.4 m potential penalties averted; input VAT credits accelerated by two months, freeing cash for marketing spend ahead of funding round. - Private-equity owned F&B chain

Problem: Fragmented POS systems led to a 2 % variance between reported and actual sales.

Intervention: Consolidated data pipeline and implemented a monthly VAT health check.

Result: EBITDA uplift of AED 3.2 m via additional input VAT recovery; clean tax file supported a successful exit at 11x EBITDA.

How ADS Auditors can help

From one-off return reviews to fully outsourced compliance, ADS Auditors blends award-winning expertise with cloud technology to make VAT filing UAE seamless. Our team of accredited tax specialists:

- Validates data integrity across ERP, POS, and bank feeds.

- Applies the latest FTA clarifications to maximise input recovery.

- Generates audit-ready documentation and digital workpapers.

- Advises on system upgrades to prepare for upcoming e-invoicing mandates.

Learn more about our end-to-end VAT services at ADS Auditors VAT advisory.

Key takeaways

- VAT filing is not just a regulatory checkbox; it directly influences cash flow, valuations, and corporate tax readiness.

- Administrative penalties can exceed the underlying tax if deadlines are missed.

- Automation, proactive health checks, and sector benchmarking are the fastest paths to a resilient VAT posture.

- Real companies have saved millions and won investor confidence by tightening their UAE VAT filing processes with help from seasoned advisors like ADS Auditors.

Staying ahead of evolving FTA requirements today positions your business for smoother audits, healthier margins, and sustainable growth tomorrow.